Suryanarayana was well placed in his company, drawing a salary of Rs 80,000 per month, and had some savings. He found a flat for sale, which he could purchase with his savings as a down payment and a bank loan of Rs 30 lakh. He got a 20-year loan from a bank at a 10 percent interest rate and an EMI of Rs 28,950 per month. It was steep, but he went ahead as it would save on his rental costs. In 2020, he got promoted and even received a bonus. A friend, who knew about his finances, told him that for his loan of Rs 30 lakh, he would pay interest of about Rs 40 lakh, before his EMI gets over. He was shocked. Even though well versed in finance, he had never calculated.

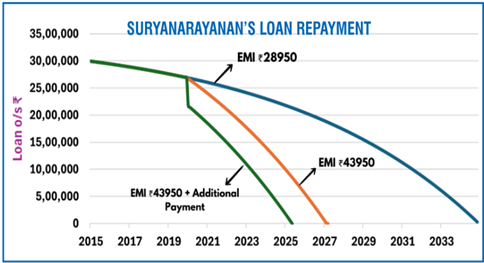

What could he do to reduce that? The friend advised that he increases the EMI by Rs 15,000 per month; he could now afford to pay this Rs 43,950. Computation showed that his EMI would now be completed in 2027 itself, reducing his total interest to about Rs 25 lakh; he would save Rs 15 lakh. The blue curve in the figure below shows the loan outstanding, year after year, for his original plan. The outstanding with the changed EMI is shown in the orange curve. He was overjoyed and made the changes. But he did still better. From his bonus and savings, he paid the bank another Rs 5 lakh in 2020. His interest dropped to Rs 20 lakh, and he would be debt-free next year itself as shown in the figure in green.

Interest amounts keep mounting in any long-term loan, even at rates as low as 10 per cent. Such loans are not accessible to low-income people in India, who are mostly less educated and may not have that good an understanding of finance. Almost 85 per cent of households in India have incomes less than Rs 25,000 per month. They could easily get into a debt-trap.

Financial literacy saves from debt trap

Devi was fortunate to be appointed as a security guard in a Chennai company, at a salary of Rs15,000/month. Her son had just finished school in 2020 and wanted to pursue an architecture course, which needed a donation of Rs 2 lakh. She took this as a loan from a nearby shop-owner at an interest of 40 per cent per annum with a tenure of 10 years (a bit over 3% per month). She had no idea that she would land up paying Rs 615,951 as interest in addition to the principal of Rs 200,000 over the next ten years. Her EMI at Rs 6800 per month was steep, and she had to now work overtime, five days a week, to make ends meet.

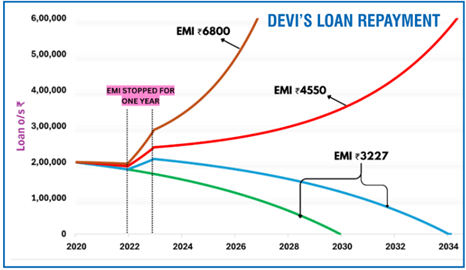

Unfortunately, she fell seriously ill two years after taking the loan. She was bedridden for six months and had stopped her EMI payments until she got another job a year later. But she never realised that she was now in a debt-trap and would never clear the loan. Even as she pays the EMI for the rest of her life, the debt will keep mounting as shown by the brown curve in the figure above. The moneylender would eventually seize all her possessions someday. The problem was well understood for quite some time in India.

Vaghul and Nachiket’s Vision

N Vaghul, former chairman of ICICI Bank, and Nachiket Mor started an organisation called IFMR to get low-income people out of such debt traps. IFMR was amongst the first tenants of IITM Research Park. Their objective was to get the low-income people to formal financing mechanism through micro-finance and NBFCs.

Devi could have got a loan at a 25 per cent interest rate from such an NBFC, but she was simply not aware of this. Her EMI would have been reduced to Rs 4550. That would have made it less difficult for Devi, but not enough for her to avoid the debt-trap due to her illness and thereby stopping of EMI payments for a year. Her loan outstanding would have still mounted, though slowly, as shown in the red curve in the figure. She would pay that forever, unless the NBFC intervened and restructured the loan and increased her EMI a bit. Rs 5000 EMI after 2023, would get her out of the debt-trap, even though the payment time would increase.

Why such high interest rates?

The question then arises: why are NBFCs providing loans at 25 per cent interest rate and not lower? The interest rate depends on three factors, namely, the cost of funds, the cost of risk and the cost of operations. NBFCs can not take deposits from the public and need to borrow funds from scheduled banks. They typically get money at interest rates of 14 per cent to 16 per cent. When loans are provided to low-income people and the ticket size is small, the risk and the operations costs easily amount to about 10 per cent. The 25 per cent interest rate that NBFCs provide would barely make them break even, let alone any profit margin. (The authors are working on technology (communications and AI) to reduce risks and operations costs, so that loans can be provided to this segment at 15 per cent in the future).

The green curve in the figure denotes the outstanding loan, if the interest rate was 15 per cent with no interruptions. The EMI for the ten-year loan would have been Rs 3227, and the total interest paid would be only Rs 1.87 lakh, less than the principal. However, the medical setback in 2022 and the subsequent stoppage of EMI for one year would extend her loan tenure and EMI payments, as shown in the blue curve in the figure, but not get her into a debt-trap. Once Devi resumes EMI payments, if the loan is restructured and EMI is slightly increased to even Rs 3800, the tenure would not go up.

India needs two things. First, an understanding of loans and interest is required for anybody, before they take a loan. IITMRP is developing an FAQ and an online tool on mobiles, which would enable this in multiple languages. Second task would be to reduce the interest rates for the underserved. Along with other Fintech for Inclusion partners at IITMRP, work is under way to reduce the costs of risk and operations for small loans to low-income people. This will enable NBFCs and banks to provide such loans at rates below 15 per cent. This will be the biggest tribute we can pay to Vaghul sir.

India needs two things. First, an understanding of loans and interest is required for anybody, before they take a loan. IITMRP is developing an FAQ and an online tool on mobiles, which would enable this in multiple languages. Second task would be to reduce the interest rates for the underserved. Along with other Fintech for Inclusion partners at IITMRP, work is under way to reduce the costs of risk and operations for small loans to low-income people. This will enable NBFCs and banks to provide such loans at rates below 15 per cent. This will be the biggest tribute we can pay to Vaghul sir.

The online tool developed by IITM Research Park for loan repayment calculation can be accessed in the following link – http://10x.respark.iitm.ac.in:3000/

– Ashok Jhunjhunwala and FINTECH for Inclusion and Marketing team of IITM Research Park

Publication: The Industrial Economist

Read the full article at: https://industrialeconomist.com/avoid-the-debt-trap/